The philosophy of NABFINS is to provide access to institutional credit to creditworthy borrowers at an affordable cost. Towards this end, the company has adopted a unique business model where a network of community based organizations are partnered with as BCs and BFs to aggregate credit demand and extend credit to them in groups based on the social collateral of joint liability.

However, it was realized that the availability of such trustworthy partners with appropriate institutional bandwidth is limited and that should not be a limiting factor for achieving the stated mission of the Company.

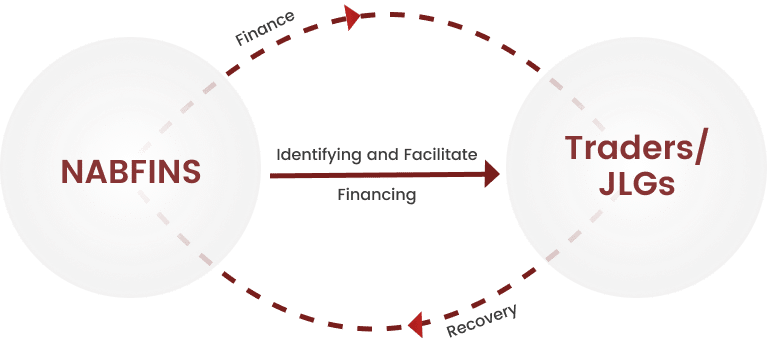

Direct Lending vertical attempts to bridge these lacunae. The Company puts in place its own resources to create a platform to provide standardized loan products at affordable cost in identifying geography at lower rates as compared to peers in the industry.

| Borrower Category | Loan Amount | Interest rate (%) | Processing fees | GST | Penal Charges | Credit Insurance |

|---|---|---|---|---|---|---|

| JLGs | Upto ₹. 7.50 lakh | 19.90% | 1% of sanctioned amount | 18.00% of processing fee | Nil | Rs 12.00 for Rs. 1000/- |