The regular interaction with the clients evidenced that, the institutions built by the poor at the grass-roots level, many times remained dormant for want of technical support and access to financial resources.

It is this realization that leads to the setting up a vertical for providing credit to such institutions which generally act as producer collectives in a different part of the Agri value chain including financial intermediation.

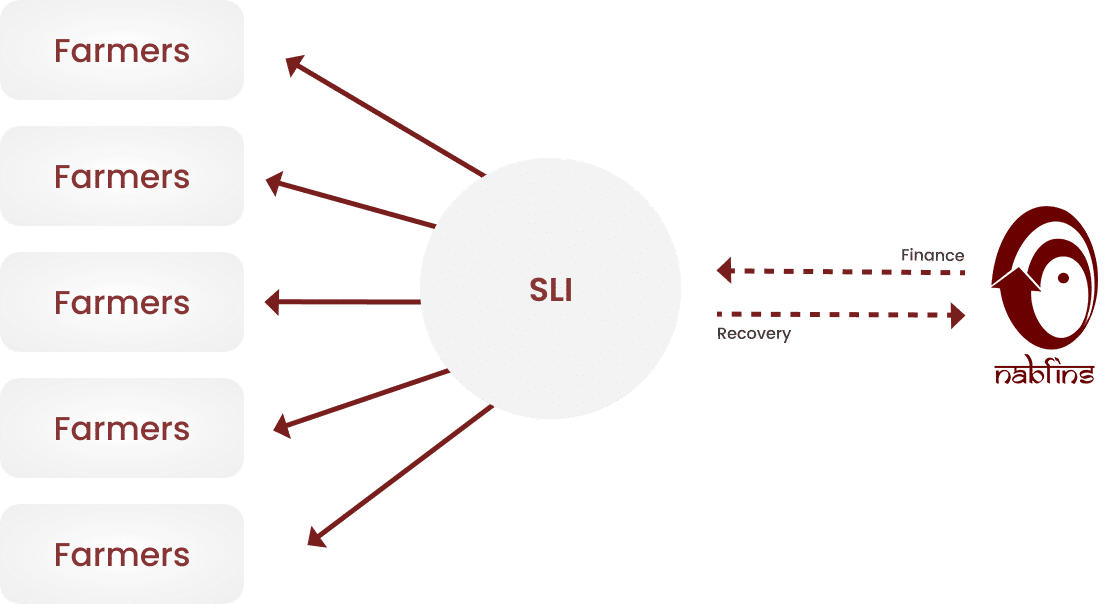

Considering the importance and overall requirement of the sector to promote and develop institutions of the poor, the company established a separate vertical focusing only on financing Second level institutions (SLIs). SLIs are generally registered entities with members of first-level intuitions as shareholders which primarily deal with business activities of primary produce/ products and works for the benefit of its members.

The main objective of NABFINS is to provide timely and adequate credit to these institutions, which are engaged in aggregation, value addition, and support services related to rural producers/ Products.

| Borrower Category | Interest rate (%) | Processing fees | GST |

|---|---|---|---|

| Institutions (Not Graded) | 11.80 to 17.30% | 1% of sanctioned amount | 18.00% of processing fee |