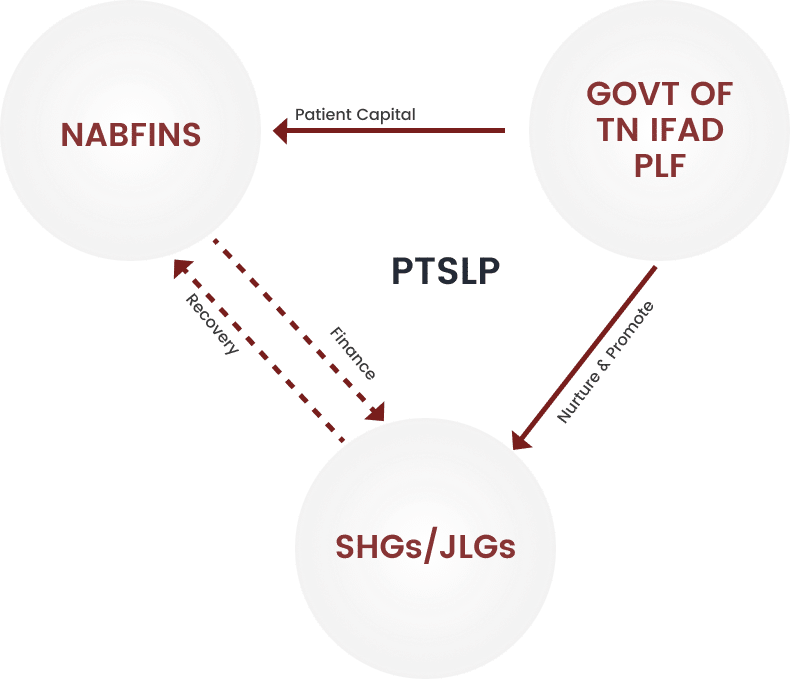

The International Fund for Agriculture and Rural Development (IFAD) assisted Post Tsunami Sustainable Livelihood Programme (PTSLP) is a program funded by the IFAD and implemented by the Government of Tamil Nadu. It envisages building self-reliant coastal communities which are able to manage their livelihoods in a sustainable manner by developing viable enterprises.

NABFINS was enrolled as a partner in this noble venture to extend credit to the project beneficiaries to set up their own micro-enterprises. The low-cost loans of the Company combined with the support from Patient Capital by Govt. of Tamil Nadu not only improve the viability of these micro-enterprises and thus the families of the entrepreneurs but also made them socially and economically empowered thus enabling the project to achieve its objectives.

| Borrower Category | Loan Amount | Interest rate (%) | GST | Processing fees | Penal Charges | Credit Insurance |

|---|---|---|---|---|---|---|

| JLGs formed by IFAD | Upto Rs. 2 lakh | 17.85% | 1% of sanctioned amount | 18.00% of processing fee | Nil | Rs.2.92 for Rs.1000 |

| Loans from Patient Capital | 25% of project cost | 4% | 1% of sanctioned amount | 18.00% of processing fee | Nil | Rs.2.92 for Rs.1000 |

Post Tsunami Sustainable Livelihood Program