Partners - Business & Development Correspondents & Facilitators

Partners – Business & Development Correspondents & Facilitators

The group-based lending approach, which was pioneered in India by NABARD has been recognized the world over. The same has been adopted by NABFINS in meeting the credit needs of the poor and needy who do not have assets/collaterals. The social collateral emerging from the group dynamics, peer pressure are leveraged to extend credit to the poor. The Self Help Groups (SHGs) / Joint Liability Groups (JLG) are utilized as a tool for credit delivery.

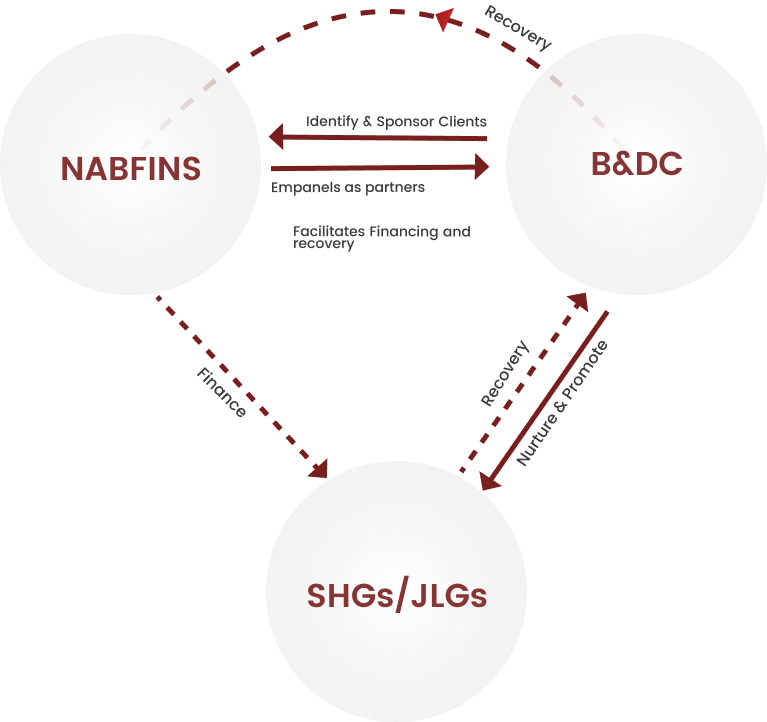

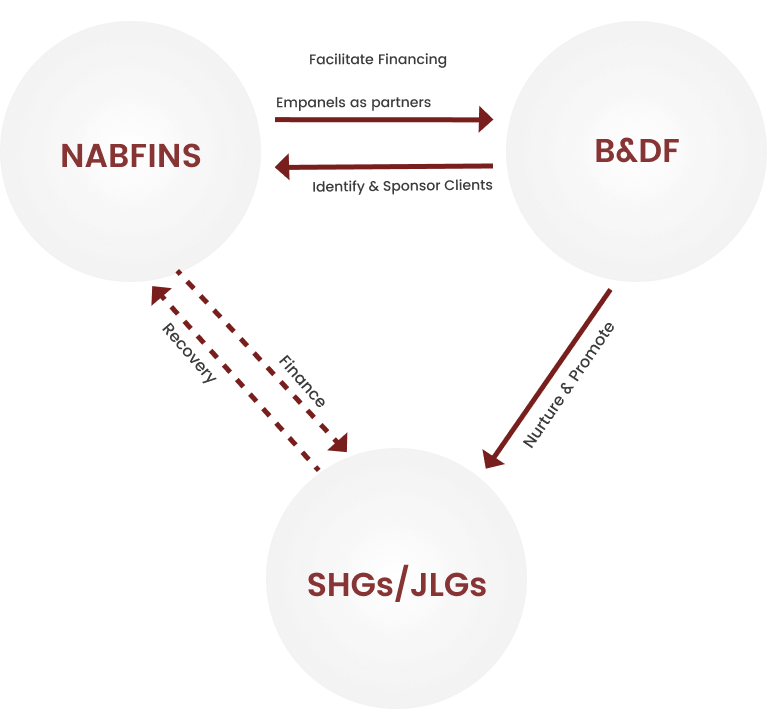

Understanding and recognizing the role played by the Community based organizations in the form of NGOs, Trusts, Producer collectives in promoting and nurturing the concept of self-help, the company has empanelled such agencies, who have connected with the needy as partners. Such an approach not only enables faster outreach to the needy but also helps in identifying the needy persons and assessing the creditworthiness in a cost-effective manner

These partners, Business & Development Correspondents/ Facilitators are expected to undertake the following activities

- Promoting, nurturing, and monitoring of groups

Identification of borrowers - Collection and preliminary processing of loan applications including verification of primary information/data

- Creating awareness about products, provide advice on managing money and debt counseling

- Processing and submission of applications to NABFINS

- Promotion and nurturing SHGs/ JLGs/ producers’ groups ;

Post-sanction monitoring

There are more than 300 such partner agencies at present, of which about 200 are active.

Interest rates on loans

As per the mandate of the Company, the rate of interest charged by the Company on the loans is the lowest among all the NBFC MFIs in India.

Interest rates on loans

As per the mandate of the Company, the rate of interest charged by the Company on the loans is the lowest among all the NBFC MFIs in India

| Borrower Category | Loan Amount | Interest rate (%) | Processing fees | GST | Penal Charges | Credit Insurance |

|---|---|---|---|---|---|---|

| SHG’s | Up to Rs.15 Lakh | 21.15% | 1% of sanctioned amount | 18.00% of processing fee | Nil | Rs 0.84 per Rs.1000/- |

| JLG’s | Upto Rs. 7.5 Lakh | 21.15% |

Business & Development Faciliator

Business & Development Correspondent