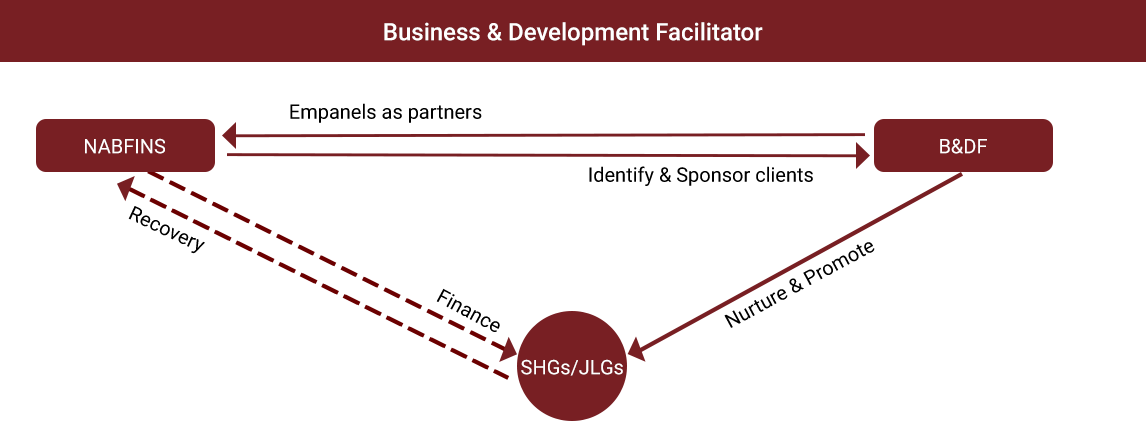

Business & Development Facilitators

Business Facilitators are intermediaries such as, NGOs/ Farmers’ Clubs, cooperatives, community based organisations, IT enabled rural outlets of corporate entities, Village Knowledge Centres, Agri Clinics/ Agri Business Centers, Krishi Vigyan Kendras and individuals like insurance agents, retired bank employees/teachers etc for providing facilitation services. Such services may include

- identification of borrowers

- collection and preliminary processing of loan applications including verification of primary information/data;

- creating awareness about products, provide advice on managing money and debt counselling;

- processing and submission of applications to NABFINS

- promotion and nurturing Self Help Groups/ Joint Liability Groups/ Producers’ groups ;

- post-sanction monitoring;

- monitoring and handholding of Self Help Groups/ Joint Liability Groups/ Credit Groups/ Producers’ groups etc.; and

- follow-up for recovery. However, they shall not engage in cash handling including disbursements, collections etc.

- identification of borrowers

| Borrower Category | Loan Amount | Interest rate (%) | Processing fees | GST | Penal Charges | Credit Insurance |

|---|---|---|---|---|---|---|

| SHG’s | Upto Rs. 10 Lakh | 17.85% | 1% of sanctioned amount | 18.00% of processing fee | Nil | Rs 2.92 for Rs. 1000 | JLG’s | Upto Rs. 10 Lakh | 17.85% |